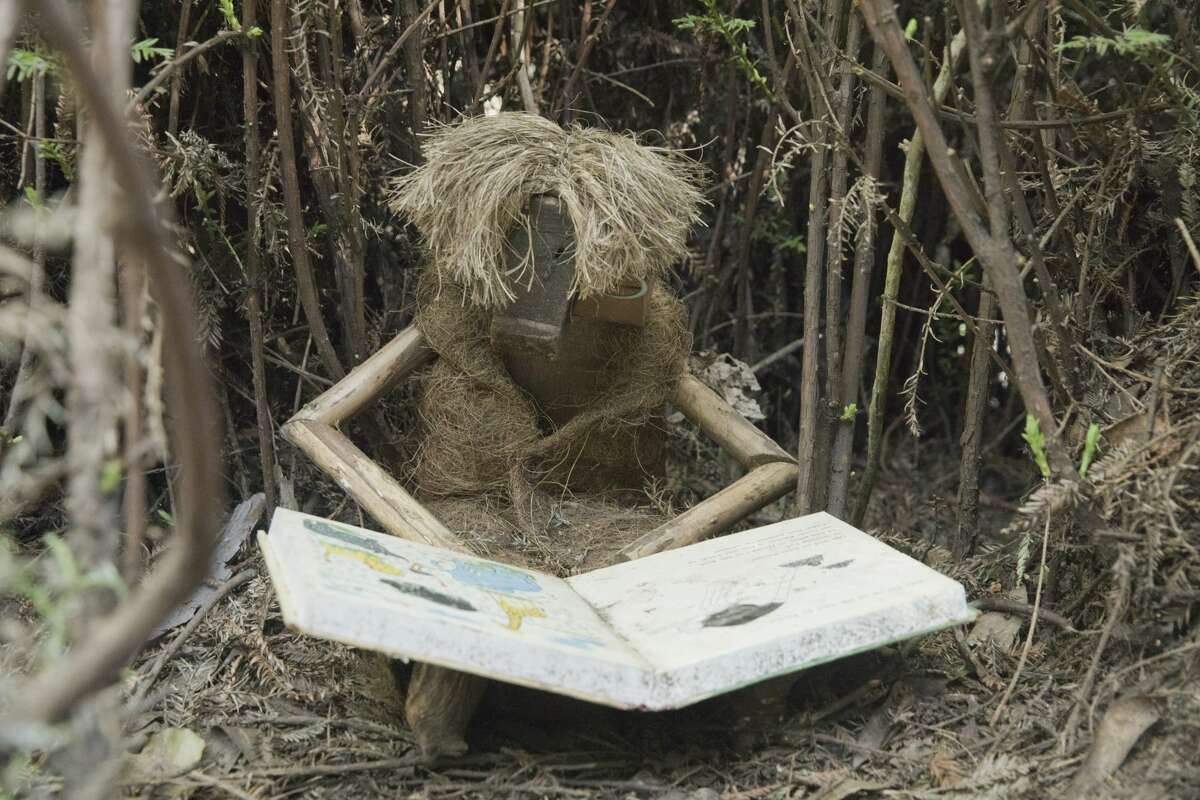

Bebe, one of the trolls along the Bridgeview Trail on March 31, 2021, in Oakland, Calif. A trio of anonymous local artists has installed a hilarious collection of wooden sculptures called "The Bridgeview Trolls" throughout Oakland's upper Dimond Canyon.

Douglas Zimmerman/SFGATEDimond Canyon in the East Oakland hills has long been a hotspot for graffiti artists. Spray-painted monikers of daredevil taggers adorn the underside of Leimert Bridge, which spans the forested gorge. Below, a tunnel that Sausal Creek runs through provides a subterranean gallery for those not willing to risk the 100-plus foot drop. In recent months, however, a more kiddie-friendly kind of public art has been drawing big crowds to the upper end of the park.

Quincy, one of the trolls along the Bridgeview Trail, hangs from a line on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEIn September 2020, a wooden figure with shaggy hair made from frayed rope appeared at the base of a redwood tree. In the following months, more scrappy statues began popping up along the entire length of the Bridgeview Trail.

Arthur was one of the first trolls along the Bridgeview Trail.

Douglas Zimmerman/SFGATEA blockheaded doll lounged in a mini-hammock strung up in the crotch of an oak. A giant caterpillar constructed from a twisted log, with pool balls for eyes, slithered near the rope swings. Amongst the ivy-covered hillsides, grinning creatures fashioned from fallen branches and construction detritus peered out at hikers.

Frank and Filbert, two of the trolls along the Bridgeview Trail, on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATESo far this spring, the sun-dappled canyon has been crawling with children in a scene reminiscent of the Pokémon GO craze, except now kids are searching for endearingly makeshift statues instead of digital monsters. On a Nextdoor post about the mysterious creatures, one neighborhood resident exclaimed, “This is better than ‘Where’s Waldo!’”

Jennifer Griest points out for her son Quentin one of the trolls, named Bebe, along the Bridgeview Trail on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEThe anonymous trio of artists behind “The Bridgeview Trolls,” the name for this ongoing project, is thrilled by the response. “We just did it for fun,” one of them told me, in their first media interview. “To see happy families out there is great, because a lot of kids don't want to go outside, they just want to play video games.”

Grandpa, of the trolls along the Bridgeview Trail, on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEThe trollmakers only want to be identified by their initials (C, D, and M), but they were willing to share some details about themselves and the origins of this whimsical installation series. C is a graphic designer, D is an electrician, and M is C’s 8-year-old son, who just received his first set of tools for Christmas. While C and D — they’re a couple — handle most of the troll design and construction, M claims credit for the idea of “putting little guys in the woods.” The inspiration struck while the trio was strolling along Bridgeview Trail. “We realized that there are all these little alcoves and the redwoods form a kind of cathedral. So many great little places to tuck things,” D said, explaining how they chose the location of their unsanctioned “pandemic project.”

A family points out Iggy Fozzwich, one of the trolls along the Bridgeview Trail on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEThe mythological connection between trolls and bridges led to the name of this motley assortment. Taking a cue from the Danish artist Thomas Dambo, who constructs massive trolls from recycled materials, C, D and M fashion their trolls using materials they find in the forest and whatever other scraps happen to be lying around. The body of the first troll, “Arthur,” is a chunk of redwood left over from a Victorian house that D had been rehabbing; his legs are lichen-covered sticks. In the vein of jazz musicians, the trio improvise as they work, with final creations sometimes bearing little resemblance to initial sketches.

Kramer, one of the trolls along the Bridgeview Trail, on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATETheir biggest limitation is space. The laboratory where the trolls are born is C’s dining room, although she got rid of her table and replaced it with a work bench, so little dining takes place there now. Plus, her small apartment is now perpetually covered in sawdust.

Mokee, one of the trolls along the Bridgeview Trail, hangs from a tree branch on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEThey often run into fans of their work while installing new trolls, which usually happens on weekends. During these visits, the trio also collects poop bags left by careless dog owners and other trash they see along the trail. “So far, we've gotten really good feedback,” C said. “And we're trying to do it in the least invasive way possible, so we don’t hurt the environment.”

A hiker climbs some steps along the Bridgeview Trail on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEDespite these efforts to limit negative impacts, a few local residents have complained of increased noise (likely the squeals of laughing children) and overcrowded parking on nearby residential streets. In order to encourage good behavior, C, D and M have begun leaving maps of the trolls’ locations at the trailheads, which include recommendations on respecting the neighborhood and where to park (Due to very limited parking on Bridgeview Drive, Monterey Boulevard is strongly encouraged).

Jupiter, one of the trolls along the Bridgeview Trail on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEThe maps also include the trolls’ names, which have proceeded in mostly alphabetical order from Arthur and Bebe up through Tabitha, the most recent addition. The next member to join the crew will be Sad Stu, although his arrival may be delayed by the fact that much of the trio’s efforts are now devoted to repairing the existing trolls. Besides contending with wind and rain, several of the figures have lost limbs at the hands of overzealous children.

Tabitha, one of the trolls along the Bridgeview Trail on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATEThe artists are committed to completing the alphabetical assortment, but they’re “locked in a heated debate” about what to do after Z. Placing trolls in other parks throughout Oakland is one option, but C said that they “don’t want to jump the shark” and acknowledged that “at some point, the trolls will just have to live on their own in the woods” without the trio’s constant upkeep.

If the history of unsanctioned public art projects in the East Bay is any indication, other amateur artists will build on the Bridgeview Trolls in exciting and unexpected ways. From the towering “mudflat sculptures” that once lined the Emeryville shoreline to the many eclectic installations on Albany Bulb to the beloved gnomes still seen at the base of countless utility poles throughout Oakland, this region has a long track record of spontaneous collaboration. The first “guest troll” just popped up on Bridgeview Trail and C, D and M are thrilled by its mysterious appearance.

A "guest troll" that appeared along the Bridgeview Trail on March 31, 2021, in Oakland, Calif.

Douglas Zimmerman/SFGATELiam O’Donoghue is the host of "East Bay Yesterday," a podcast that explores the history of Alameda and Contra Costa counties. Follow him on Twitter.